Essex Global Environmental Opportunities Strategy (GEOS) – Review and Outlook

Fourth Quarter and Year ended December 31, 2025

2025 was an extremely successful year for clean technology, both on the ground fundamentally, and for the equity shares of companies enabling economic progress with less resources. This success was reflected across the Essex Global Environmental Opportunities Strategy (GEOS) themes, from power technology to clean tech & efficiency and renewable energy, based on the two primary demand drivers we have been investing in for the past few years:

- increased domestic power demand

- de-globalization driving capital investment

We have consistently observed and responded to negative sentiment regarding clean tech throughout 2025, and want to reiterate that on the ground, clean tech fundamentals are strengthening as the demand drivers continue. While it is still early in the recovery, some segments of clean tech equity shares are at fair valuation in our opinion, and we have been taking profits and deploying capital to the shares of companies where we project more attractive opportunities based on valuation and earnings growth analysis.

Performance and Transactions

For the full year 2025 ending December 31, the Essex Global Environmental Opportunities Strategy (GEOS) returned 24.40% (23.18% net), versus 19.37% for the iShares MSCI World ETF (URTH). The Wilderhill Clean Energy Index[1] posted 53.00% for the full year. For the fourth quarter ending December 31, 2025, GEOS returned 0.92% (0.66% net) versus 2.33% for URTH and 6.54% for the Wilderhill.

Performance for the year was led by domestic rare earth producer MP Materials (MP), which rallied on our long-standing thesis that China has a complete lock hold on the global rare earth market, to which many industries depend, from electric motors to defense technology. MP is currently the only domestic supplier for neodymium-praseodymium oxide (NdPr), the element used to create the world’s strongest permanent magnets. MP has been held since late 2020, and we added to share weight on weakness in prior years, just as we trimmed several times on the 337% rally in 2025 and exited in August based on extended valuation amidst several potential domestic competitors. Fluence Energy (FLNC) was a recent August addition to GEOS, providing stationary battery storage for electric utility and industrial customers, including data centers. Data centers experience extreme power usage fluctuations, and Fluence applications smooth out power surges to optimize electricity consumption. After an initial purchase under 1%, FLNC shares rallied strongly, and we pared exposure back in October to 2%. Another strong performer for the year provides logistics planning and optimization for manufacturing and warehouse fulfillment – Kion Group (KGX.GY), based in Frankfurt. Kion provides solutions such as asset tracking systems that can enhance manufacturing processes such as used by Airbus. Kion warehouse and distribution automation systems can inventory, box and ship product using large and small form robotics, enhancing productivity and profitability in thin-margin and labor-starved businesses. Rounding out the top performers for 2025 is Ouster (OUST), a leader in light detection and ranging (LiDAR) applications used for autonomous driving, industrial automation and geological mapping. Ouster LiDAR uses time of flight (ToF), sending laser pulses to detect velocity. In August we sold our position in Ouster and used the proceeds to purchase a new holding, Aeva Technologies (AEVA), a competing LiDAR company using frequency modulated continuous-wave light detection and ranging (FMCW) LiDAR that operates more like a radar system and is often referred to as 4D LiDAR. The competitive advantage of Aeva’s offering is FMCW can measure instantaneous velocity, which is the fourth dimension, leading to better use for applications such as autonomous driving. Aeva chips are small, and we believe will lead to broad adoption, for uses beyond driving such as robotics. There are many competitors in the LiDAR arena, and we believe Aeva has differentiation with its FMCW offering, as exhibited by a customer win last year with Daimler Truck.

Detractors for the year was led by the automotive recycling firm Copart (CPRT), and the shares were sold in late October on continued share price weakness and signs of continued margin compression. The Chinese electric vehicle (EV) and battery firm BYD (BYDDY – US ADR) was an underperformer, despite gaining global market share in China, APAC, India and the EU in EV sales last year. BYD did experience some market concerns amidst rising domestic competition that did erode pricing in 2025. We believe that despite the EV sales stagnation here in the US, the EV cycle will continue to take share as a percentage of overall automotive sales and concur with Bloomberg’s estimate of 28% global share for EVs in 2026, up from 25% in 2025. EVs are taking share globally as battery charging infrastructure is rolled out more significantly, and battery pack prices continue to decline – now approaching $105/kWh, allowing price parity with internal combustion engine vehicles. BYD has lower priced vehicle offerings, with a $27,000 car for India. Importantly, BYD also has the potential to gain traction with their battery technology in stationary storage applications. We did trim the BYD portfolio weight in mid-December and are awaiting signs of improvement in China. Rounding out the top four underperformers for 2025 were IDEX (IEX) and Chart Industries (GTLS) which were sold from GEOS in August and June respectively.

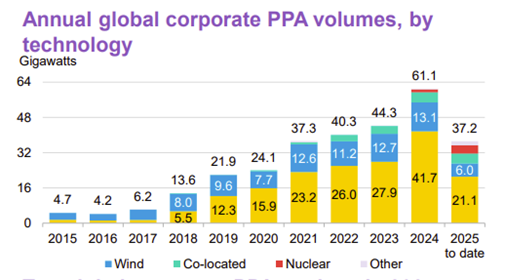

At the start of the fourth quarter, we added two new solar companies, Array Technologies (ARRY) and Shoals Technologies (SHLS), with each enhancing utility scale solar efficiencies. Array provides tracking technologies that allow ground mounted solar arrays to follow the arc of the sun during the day, while Shoals manufactures solutions that connect solar and battery storage systems to the grid and user facilities. Late in December we initiated another solar position with Enphase Energy (ENPH), which has industry-leading technology with its micro-inverter solutions, which are mounted behind each individual solar panel, to optimize energy output and safety at the panel level. Enphase automatic shutdown technology is another differentiation and is being designed into EU safety protocols. Enphase micro inverters convert direct current (DC) to alternating current (AC), so the electricity can be used, stored with Enphase battery solutions, or sent to a local virtual power plant (VPP). Enphase has expanded offerings for homeowners and industry at the meter level, called collaring, with insights on power generation and usage, coupled with integrations of storage, EV charging amidst time of use utility pricing. Despite skepticism here in the US on solar, we are constructive domestically and globally given the key driver mentioned above, increased power demand. Solar is cheaper than any other form of power and has massive competitive advantage with fast install ability. Time and cost are important factors as increasing electricity rates hit our headlines and become political third rails in this year of mid-term elections. These three new solar holdings are joined by First Solar (FSLR) and Nextpower (NXT – formerly named Nextracker), the leading utility scale solar module provider, and leading solar tracker firm respectively. The Nextracker renaming reflects deepening offerings beyond tracking technology to facility energy management solutions. While nuclear is receiving the bulk of market attention currently, corporate power purchase agreements (PPAs) continue to favor solar power given these competitive advantages, as exhibited on the following Bloomberg chart from December:

Source: Bloomberg

Towards the end of December, we trimmed Primoris Services (PRIM) and GE Vernova (GEV), both strong performers in 2025 and in the GEOS power technology theme. The fundamentals for both holdings are intact, albeit given performance the shares are at price parity.

Outlook

We believe we are at an important inflection point for clean technology investing, as market dynamics are placing a premium on commercial viability, in the form of market adoption and financial discipline. This is not the cycle of 2021, with loose capital, and geopolitical frictions are placing a premium on business operations execution from supply chain assessment to manufacturing locations. Building on the parlance of Warren Buffett, the tide is not only out but is an ultra-low spring tide. This creates opportunity, as uneconomic business models can be identified and avoided just as the market drivers for clean tech continue to amplify. We believe the winning combination for listed companies is capital stewardship where management teams allocate capital to their operations and optimize profitability and ultimately distributed earnings for shareholders. In this more competitive market environment, competitive differentiation is of utmost importance – this is not, nor is it ever the time to invest in lab experiments that can never scale commercially, and constantly erode shareholder capital (more on capital destruction here: https://www.essexinvest.com/insights/giving-cleantech-bad-name). We put a premium on evaluation of returns on equity and balance sheet fortification as the results of commercial viability and competitive differentiation.

The two major drivers for our clean technology approach with GEOS currently are:

- increased domestic power demand

- de-globalization driving capital investment

These drivers amplify demand for the urgent need to generate growth amidst volatility, from input pressures such as energy, labor or materials. Doing more with less is the very essence of clean technology investing. Each of these drivers are interrelated – the more economies deglobalize; the more input costs will rise. While most of the current GEOS portfolio is tied to these two drivers, we offer the following current examples:

Industrial automation:

GEOS holdings such as Cognex (CGNX), KEYENCE (6861 JP), KION Group (KGX GY), Samsara (IOT), and Proto Labs (PRLB) enable goods and services to be sourced, manufactured, stored and delivered with less resources, from energy to materials. Samsara provides customers with a connected operations cloud coupled with an internet of things (IoT) hardware suite for logistics planning to optimize efficiency and safety. One offering is called the Asset Gateway and allows transportation logistics firms to track assets from railway cars, to shipping containers, trucks and packages, optimizing route delivery while leveraging generative AI for maintenance alerts and solving for efficient delivery routes. Cognex provides machine vision systems so factory or warehouse systems can see what they are doing while performing and learning tasks. The Cognex system is more productive and accurate than the legacy laser and bar code systems. Cognex systems can make assembly lines fun faster with more productivity, providing enhanced profitability with more throughput and less energy usage.

Advanced battery technology:

The holy grail in the battery world is providing more power – energy with less weight, so called high watts per kilogram. GEOS has exposure to advanced battery materials companies such as Contemporary Amperex Technology (CATL – 3750 HK), Amprius Technologies (AMPX), and Toray Industries (3402 JT). Toray is developing advanced battery technology for the post-lithium-ion era, focusing on solid state batteries using ion-conductive polymer membranes. Toray’s latest battery separation material is designed with thermal shutdown properties to prevent battery fires caused by short circuits. CATL is the current global leader in chemical energy density, volumetric packaging and charging speed. CATL just commercialized a nickel manganese cobalt (NMC) battery that reaches 255-watt hours per kilogram, enabling 620-mile EV range.

Advanced semiconductors:

GEOS has exposure to ON Semiconductor (ON) and Infineon Technologies (IFX GR) which manufacture power semiconductors using advanced materials such as gallium nitride (GaN) and silicon carbide (SiC) enabling more efficient operating systems, and the ability to do more heavy lifting in hostile environments. Think about the ability of an EV drivetrain to accelerate with less stress on the electric motor while saving battery life. SiC semiconductor chips are also used in high temperature power applications such as electric transformers or EV fast charging. EVs have computers throughout the platform, and Infineon has developed a centralized signal processing application with leading computing performance for automated smart driving. GEOS holding Rivian (RIVN), the EV manufacturer is highly differentiated in their zonal architecture design for their EV lineup, which simplifies the manufacturing process and provides a much-enhanced driver and ownership experience versus most of the legacy automotive companies with more complex and costly EV designs. Rivian has a partnership with Infineon for the upcoming mid-priced R2 platform, using Infineon SiC power modules and microcontrollers that will enhance performance and lower manufacturing costs with less vehicle wiring.

These are three important examples of GEOS exposure to the two major drivers for clean tech we are currently observing and implementing in portfolio management. Importantly, the GEOS power technology theme is also centered on the power demand driver, to which we have written extensively throughout the past several years. We continue to be stunned by the general dismissals by the public about clean technology, just as they are complaining about power rates, investing in NVIDIA shares, or watching news about tariff wars over mineral exports. We believe GEOS solves these current complexities, and the contrarian indicators for the opportunity are flashing green.

Disclosures

This commentary is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. The opinions and analyses expressed in this commentary are based on Essex Investment Management LLC’s (“Essex”) research and professional experience and are expressed as of the date of its release. Certain information expressed represents an assessment at a specific point in time and is not intended to be a forecast or guarantee of future results, nor is intended to speak to any future periods. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties.

This does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product, nor does it constitute a recommendation to invest in any particular security. An investment in securities is speculative and involves a high degree of risk and could result in the loss of all or a substantial portion of the amount invested. There can be no assurance that the strategy described herein will meet its objectives generally or avoid losses. Essex makes no warranty or representation, expressed or implied; nor does Essex accept any liability, with respect to the information and data set forth herein, and Essex specifically disclaims any duty to update any of the information and data contained in the commentary. This information and data does not constitute legal, tax, account, investment or other professional advice. Essex being registered by the SEC does not imply a certain level of skill or training.

[1] The Wilderhill Clean Energy Index (ticker: ECO) is a modified equal dollar weighted index comprised of publicly traded companies whose businesses stand to benefit from societal transition toward the use of cleaner energy and conservation.

Please find important disclosures here