Essex Global Environmental Opportunities Strategy (GEOS) April 2024 Update

The Orchestra

Over the past decade, we have written extensively about the importance of the electrical grid, especially the strong positioning of companies delivering modern technologies to power our economy more efficiently from industry to home. The companies enabling electricity delivery and grid modernization have done well over the past several years, but there is a step change happening now. The demand drivers such as onshoring industry, and the rise of solar power are rapidly increasing the need for an enhanced grid, and this trend will accelerate. GEOS has extensive exposure to our power technology theme, and while these companies drove performance for the first quarter of 2024, we believe we are still in early innings.

There are several key demand drivers in place that are leading to the step change in spending of our electrical grid, and they are long-term and multi-faceted:

AI – while data center electricity needs have increased marginal demand the past few years, artificial intelligence will compound it by over 60% in the next several years. Boston Consulting Group estimates that data centers will soon use as much power as 40 million homes – more than residential demand in California. The International Energy Agency estimates that just 1 AI learning model requires the power that 100 households use in a year. Schneider Electric has determined that data center power needs will go from 57 to 93 gigawatts withing five years – over 8% of our current grid capacity. This demand simply cannot be met currently. According to the data center developer Digital Bridge, we are in the proverbial power hole by 8 gigawatts for data centers.

Onshoring – corporates and policy makers alike determined as we emerged from the pandemic that nimble, just in time supply chains are fraught with economic and geopolitical risks. The new mantra, echoing from shore to shore in bipartisan fashion is build it here in America. According to GEOS power technology holding Primoris Services, almost 70% of US manufacturers surveyed have begun reshoring efforts in the past year. This trend has been catalyzed by the Inflation Reduction (IRA) and Chips Acts, which incentivize US-based manufacturing with tax incentives.

Source: Grid Strategies

Since 2021, commitments for industrial and manufacturing facilities equate to $481 billion and 200 manufacturing plants based on the chart above, and utilities in no way can meet this level of demand growth for power. Many of these planned facilities will be enabling the critical move to new energy and clean technologies, manufacturing the very components used for electric vehicles and battery storage. We are told one semiconductor fabrication facility requires at least 400 megawatts of electricity. On a related note, the majority of the plans are based in Republican controlled states, exemplifying our belief legislation such as the IRA has less political risk than market consensus in this election year.

Antiques – as we have already communicated extensively, our electrical grid is dumb, linear, analog and binary, resting on more than 120-year-old technology protocol. The central telephone switchboard, in use a generation before this writer is a strong analogy for the current state of our electrical grid infrastructure. While our centralized, analog voice communication protocol was fully phased out over 60 years ago, the electrical substation on the right below is still the default today and is as old as that switchboard. The benign neglect of electricity distribution rests well beyond substations. According to Grid Strategies, the national installation rate of high voltage transmission lines has dropped by over 60% in recent years.

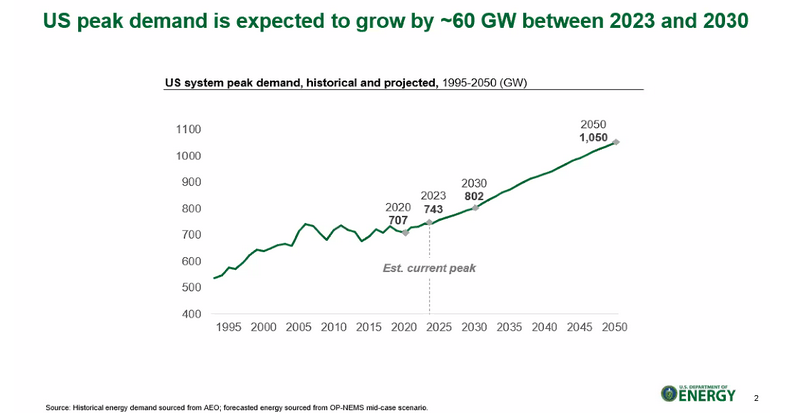

Much more – severe weather is leading to peak demand loads in the summer and winter that are increasing and cannot be met with power reserves and our Department of Energy is modeling more:

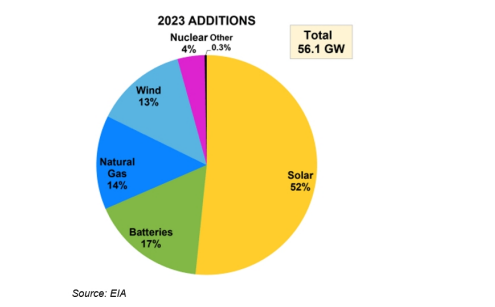

As we move to modern energy sources that are more efficient, less costly and safer for our planet, the grid needs to transition from dumb to smart – from analog to digital. We have strong conviction that this transition will be profitable for the companies with commercially viable and leading technologies and services for this important trend. It is for this reason that GEOS has over 50% portfolio exposure in the power technology and renewable energy themes. We own companies that are providing modern equipment and technologies, with more reliable power sources than obsolete, centralized fossil fuel methods. As we add modern generation sources to our grid, we lower carbon emissions and “do more with less” – our very definition of clean technology. Last year, no coal was added:

As our smarter grid evolves and allows cleaner energy with less risk (from geopolitical, to commodity and environmental), these nodes need to be, in the words of GEOS holding American Superconductor (AMSC), “orchestrated and harmonized.” The electrical grid orchestra needs a virtual, pardon the pun, conductor. American Superconductor enables our antiquated grid to function as demand increases and smarter power sources – musicians are added to the virtual orchestra. AMSC provides solutions to connect the grid, enhance resiliency, increase load serving capacity and regulate voltage. As the grid gets smarter, given the sudden demand and old legacy technology, many participants are opting for their own energy sources, from solar arrays to battery storage or fuel cells. These micro grids need to be orchestrated, and AMSC can migrate power quality issues if intermittent renewable sources distort the harmonics of the grid. Instead of a dumb, linear power delivery system, we now have a living, distributed system that is more flexible, resilient, cleaner and reliable. We are in the very early days here, and this transition will be complex yet transformative. AMSC is one example, and GEOS holds many more that we believe can profit while saving our planet.

We could write a book on the multitudes of reasons the GEOS power technology theme is one of our highest conviction themes. When you hear and read the abbreviation “AI”, please know this exciting technology is not feasible without power – electricity, and it is just one of many catalysts for the power technology holdings in GEOS.

Disclosures:

This commentary is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. The opinions and analyses expressed in this commentary are based on Essex Investment Management LLC’s (“Essex”) research and professional experience and are expressed as of the date of its release. Certain information expressed represents an assessment at a specific point in time and is not intended to be a forecast or guarantee of future results, nor is intended to speak to any future periods. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties.

This does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product, nor does it constitute a recommendation to invest in any particular security. An investment in securities is speculative and involves a high degree of risk and could result in the loss of all or a substantial portion of the amount invested. There can be no assurance that the strategy described herein will meet its objectives generally or avoid losses. Essex makes no warranty or representation, expressed or implied; nor does Essex accept any liability, with respect to the information and data set forth herein, and Essex specifically disclaims any duty to update any of the information and data contained in the commentary. This information and data does not constitute legal, tax, account, investment or other professional advice. Essex being registered by the SEC does not imply a certain level of skill or training.

Please find important disclosures here.