Essex Global Environmental Opportunities Strategy (GEOS) February 2024 Update

Got AI?

Performance for the Essex Global Environmental Opportunities Strategy (GEOS, Strategy) languished in January 2024 after strong performance in November and December. Our take is market sentiment continued to favor mega cap technology – what drove the equity market last year, as investors remain completely risk averse until they see the Federal Reserve lower interest rates. As has been the case in most environments since GEOS inception, the Strategy outperformed the Wilderhill during this period of stress on clean technology, while underperforming the primary MSCI Index.

We sold positions during the month where we anticipate declining fundamentals, such as Aptiv, designer of EV systems, and Bloom Energy, whose free cash flow progress we believe is at risk. We trimmed Badger Meter on continued price strength, and purchased Trimble, which delivers technology to be used in agriculture, construction, transportation, and surveying. The Trimble precision agriculture business is their fastest growing segment, enhancing farmer returns on investment and reducing inputs as well as harmful nutrient runoff using precise fertilizer applications. Trimble recently announced the Connected Climate Exchange, a carbon marketplace to connect and aggregate verified carbon data across the agricultural value chain, enabling farmers to participate in the carbon markets as they deploy best environmental practices.

Despite the negative sentiment regarding clean technology stocks currently, we continue to see strong and timely opportunity, given the historically high extremes in current valuations between smaller clean tech and the broad market. The GEOS price/earnings ratio is in line with the Index at 20 times, with greater EPS growth, valuation to free cash, and sales growth.

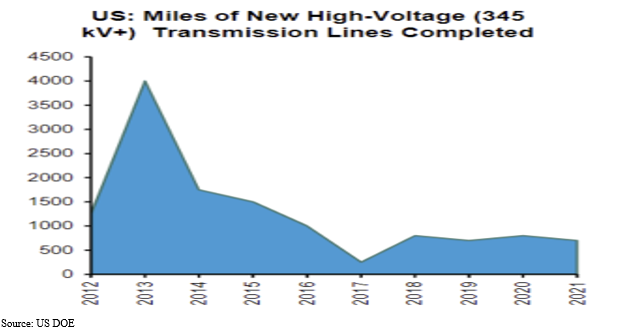

The financial media has focused on AI and machine learning (ML), in highlighting the obvious market leader that has driven public equity returns this past year. Deeper thinking on the rise of AI, and the need for increased data center build brings us back to GEOS, and enhanced energy output. As we wrote a decade ago, it takes British thermal units of energy (BTUs) to power an economy – GDP. The energy equation we adopted was GDP = BTU. This formula is more relevant today, given several important and sustainable drivers, primarily the drive towards increased electrification as demand for power doubles. Historically, electricity demand in the US has averaged 1-2% per annum yet we believe demand for electricity will double to 4% annually, driven by the rise of electrification, and the data center build, which is in the first quarter of a four quarter, decade long build, similar to the cloud computing transition. We believe data center customers will continue to prefer renewable energy, given the distributed and clean nature, but this trend will require electric grid interconnect. As we have written, the queue for grid connect is more than our current installed generation capacity. According to data center engineering firm DigitalBridge, the globe will need more than 24 gigawatts for power for data centers in the next several years, and there are only 8 gigawatts available. As our economy continues to adopt distributed energy technologies such as battery storage, EVs and solar, the need for a smarter grid will become more urgent. There is a massive problem at hand, as utilities have underinvested in gird maintenance for decades. It is not uncommon for substations to be over 40 years old. Transmission line completion rates have been in decline for the past decade, as grid failure events spike given deferred maintenance and increased severe weather.

The energy equation is now more complex, as the BTUs are flowing in many different directions, and in digital fashion. The linear distribution method, of a coal generated electron flowing down a power line is dead. Now, electrons of energy might be used, or stored and then used later, or stored and then sold back using the grid connect. Along this electron ecosystem, all players require data to enable the new energy economy, from utilities managing the grid, to customers optimizing electricity usage. This new digital grid economy will eclipse the data revolution of the 2000s given the scale of our global power grid. This new energy electron is digitalized, and the ecosystem spreads from the power utility, to the transmission lines, to substations and nodes to commercial and residential users behind the meter (BHM) to their assets. This smart grid is paramount, and there is no way the old linear model would work given these demand drivers including our plans for industrial onshoring. The mill towns of the next decade for power hungry active compute, machine learning customers will drive a new smart grid, amidst the many other catalysts.

The GEOS power technology theme is our greatest weight currently, consisting of the equity shares of companies across this value chain building and managing this new grid. Exposures include dispatchable labor for maintenance and construction, maintenance and grid management parts and systems, distributed energy systems, utility customer management platforms, and technologies for power management and conservation. Additionally, we hold renewable power developers such as NextEra, one of the world’s largest solar and wind power developers, with a material backlog of data center customers. Hubbell estimates that 63% of their products have environmental impact driving grid modernization and hardening, resource efficiency, renewable energy and electrification. Hubbell’s products span across the smart grid, from transmission to substations at the node-level. Hubbell provides data collection systems and load controls to manage grid power levels optimizing harmonization in the face of renewable energy intermittency or severe weather. Hubbell offers a renewable energy balance of system to optimize solar power generation and delivery, from wire management systems, to grounding solutions and controls. American Superconductor provides voltage solutions to customers and utilities offering power electronics that increase power flow and reduce transmission loss. One solution can correct voltage instability problems on transmission networks, providing dynamic steady-state voltage and power factor control to regulate transmission and distribution networks, and support a stable point of interconnection for customers such as data centers or large-scale wind farms. As we progress on our grid transformation, customers such as data centers require high quality, non-intermittent power, which American Superconductor can provide. The next time you hear AI or NVIDIA, think of our GEOS power technology theme, and its companies offering solutions to this mega trend.

Disclosures:

This commentary is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. The opinions and analyses expressed in this commentary are based on Essex Investment Management LLC’s (“Essex”) research and professional experience and are expressed as of the date of its release. Certain information expressed represents an assessment at a specific point in time and is not intended to be a forecast or guarantee of future results, nor is intended to speak to any future periods. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties.

This does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product, nor does it constitute a recommendation to invest in any particular security. An investment in securities is speculative and involves a high degree of risk and could result in the loss of all or a substantial portion of the amount invested. There can be no assurance that the strategy described herein will meet its objectives generally or avoid losses. Essex makes no warranty or representation, expressed or implied; nor does Essex accept any liability, with respect to the information and data set forth herein, and Essex specifically disclaims any duty to update any of the information and data contained in the commentary. This information and data does not constitute legal, tax, account, investment or other professional advice. Essex being registered by the SEC does not imply a certain level of skill or training.

Please find important disclosures here.