GEOS Impact Insights: Tracking the Sun

September 12, 2025

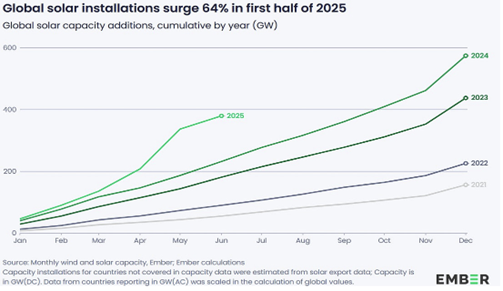

An increasingly important theme for the Essex Global Environmental Opportunities Strategy (GEOS) which captures the very essence of our definition of clean technology, or “doing more with less”, is renewable energy, and specifically, solar power. Solar is an amazing technology with steady advancements resulting in panels that are both cheaper to produce and capable of producing more energy. These attributes are leading to the rapid scaling of solar installations at just the right time, as global demand for electricity expands at rates not seen in decades. Solar energy is cheap, dispatchable and once deployed, can generate electricity at the source of demand for decades with few input costs. Global solar installations increased more than 64% in the first half of 2025 to over 380 gigawatts given these massive benefits. To put this growth in perspective versus a more appreciated technology: the world has 398 gigawatts of nuclear energy in total according to the International Energy Agency. Solar has surpassed the total and the historical nuclear installed base in six months. For the next decade and beyond, the Energy Information Administration, after polling electric utilities and power developers, expects over 50% of new electric generating capacity to come from solar, and another 30%+ from battery storage.

There are significant technology developments to further enhance the efficiency of solar, from electrical grid balancing equipment such as offered by GEOS holding American Superconductor, to solar tracking applications. A recent addition to the GEOS portfolio is Nextracker (ticker NXT), which designs and manufactures solar tracking systems. Solar trackers allow the panels to track the arc of the sun throughout the day, leading to an increase the energy output of a solar array by an average of 30% for a utility scale installation. Nextracker solutions also expand the geographies, soil types and terrain where solar arrays can be installed. Additionally, Nextracker’s technology includes severe weather abatement allowing the protective “stowing” of panels to limit damage from hailstones or wind during severe storms, or enhanced footings for flood water resilience. An impact case study for Nextracker is the Malindi Solar Power Plant, on coastal Kenya, an area which frequently experiences extremely high winds in excess of 80 miles per hour. The 52-megawatt solar project will offset over 44 thousand tons of CO2 per annum with its 157,000 solar modules powering 250,000 homes and businesses, more than equal to the local population and economy. This is the first major solar project of its kind in coastal Kenya, and the construction project employed over 250 local and trained workers. Nextracker applications are further enhancing the already differentiated solar industry with increased energy production that further lowers operating costs, increases reliability and provides additional incremental revenues greater than tracker installation costs.

Disclosures:

This commentary is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. The opinions and analyses expressed in this commentary are based on Essex Investment Management LLC’s (“Essex”) research and professional experience and are expressed as of the date of its release. Certain information expressed represents an assessment at a specific point in time and is not intended to be a forecast or guarantee of future results, nor is intended to speak to any future periods. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties.

This does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product, nor does it constitute a recommendation to invest in any particular security. An investment in securities is speculative and involves a high degree of risk and could result in the loss of all or a substantial portion of the amount invested. There can be no assurance that the strategy described herein will meet its objectives generally or avoid losses. Essex makes no warranty or representation, expressed or implied; nor does Essex accept any liability, with respect to the information and data set forth herein, and Essex specifically disclaims any duty to update any of the information and data contained in the commentary. This information and data does not constitute legal, tax, account, investment or other professional advice. Essex being registered by the SEC does not imply a certain level of skill or training.

Please find important disclosures here