GEOS Insights: Build your Dreams

July 1, 2025

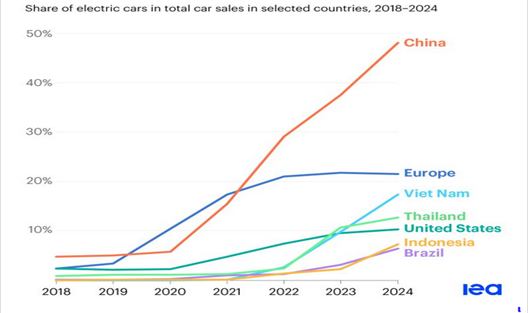

Like most everything today, electric vehicles (EVs) have been politicized. I question targeting progress, and EVs are the very essence of technological progress, leaping ahead of legacy internal combustion engine (ICE) vehicles given lower operating costs coupled with an overall more fun package to drive, from acceleration to handling and operational ease. I have been driving EVs for over eight years, have never needed service, and the vehicles enabled both local and regional transport. In the US, our car culture runs deep and had strong government support from initial highway planning in 1941 under President Franklin Roosevelt to the Federal-Aid Highway Act of 1956. Cars are a symbol of American mobility, where we have led globally with automotive design and production for a century. We are now losing the race. The majority of automotive sales will be EV-related within a decade or sooner, and China is fully aware, and is now leading global EV production. Earlier this year, Shenzhen based BYD Company (current GEOS holding) reported 2024 sales increased 12% year-on-year, while Tesla reported -1% annualized sales growth. BYD also announced the fastest charging capability available, adding 249 miles of range in a mere five minutes, solving driver range anxiety. BYD stands for “Build Your Dreams”, with attractive pricing points and a fresh lineup which is taking share given Tesla’s aged lineup. While BYD is not exporting to the US given trade and tariff restrictions, they are entering the EU and have established a presence in India, the fastest growing e-mobility market. Their best-selling vehicle pictured above is the Seagull, pricing under $28,000. Not all is finished for Detroit automakers, but their pause on EV development is hindering global sales in the EU and in the market that matters today per the chart below, China.

EV design and production could not be more different than ICE vehicle manufacturing, with Detroit OEMs and most in the EU experiencing manufacturing complexities and quality problems trying to create EVs using legacy ICE designs and manufacturing techniques. EVs are the essence of the digital, electrical transformation, with enhanced driver infotainment systems in the cockpit and driving performance optimized by scores of sensors and central processing units (CPUs). We believe Rivian Automotive (current GEOS holding) to be very well positioned amongst the EV manufacturers, with their ground up zonal architecture, enabling smooth over the air feature updates which traditional OEMs cannot achieve. Traditional OEMs use over 80 electrical control units (ECUs) in a vehicle, which are minicomputers for functions and communication. Rivian uses just 17, and is on path for further ECU consolidation, allowing close to 2 miles less cabling in each vehicle, lowering cost, weight and providing enhanced systems management. The two existing Rivian products, the R1T and S, are setting the stage for the launch next year of the R2, which will be a mid-sized SUV priced at ICE parity, $48,000. VW has taken notice and will be using Rivian architecture for their forthcoming EV offerings, to sidestep massive software complexity.

We conclude with our belief that the market is completely misinformed thanks to sensational headlines that EVs are solely dependent on government incentives, are charged by coal power, or are too expensive to operate with no range. Such were past exclamations that cellphones would never mainstream, and PCs would never be on desks. EVs are the future, just one of many clean tech segments enabling our economy to run with less resources and in safer fashion.

Disclosures:

This commentary is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. The opinions and analyses expressed in this commentary are based on Essex Investment Management LLC’s (“Essex”) research and professional experience and are expressed as of the date of its release. Certain information expressed represents an assessment at a specific point in time and is not intended to be a forecast or guarantee of future results, nor is intended to speak to any future periods. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties.

This does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product, nor does it constitute a recommendation to invest in any particular security. An investment in securities is speculative and involves a high degree of risk and could result in the loss of all or a substantial portion of the amount invested. There can be no assurance that the strategy described herein will meet its objectives generally or avoid losses. Essex makes no warranty or representation, expressed or implied; nor does Essex accept any liability, with respect to the information and data set forth herein, and Essex specifically disclaims any duty to update any of the information and data contained in the commentary. This information and data does not constitute legal, tax, account, investment or other professional advice. Essex being registered by the SEC does not imply a certain level of skill or training.

Please find important disclosures here.