GEOS Insights: Season of Solstice

Photo: Bill Page, 2024

As we approach the winter solstice in the Northern Hemisphere, this special day has both cultural, spiritual and astronomical significance. The solstice symbolizes birth and renewal as the days grow longer after winter solstice. Astronomically, this event occurs twice a year globally in each Hemisphere, when the Earth’s axis is tilted at its farthest point from the Sun. It is also the season of light, as traditionally people bring the light into their dwellings for holiday celebrations.

As we approach year end, we are also reflecting on the past year professionally, as we manage our thematic clean tech strategy, Essex GEOS. After recent travels featuring conferences and meetings, as well as industry peer conversations, we want to make some points we have been expressing often lately, to questions, concerns and confusion about the state of clean technology progress.

Clean technology is successful and progressing.

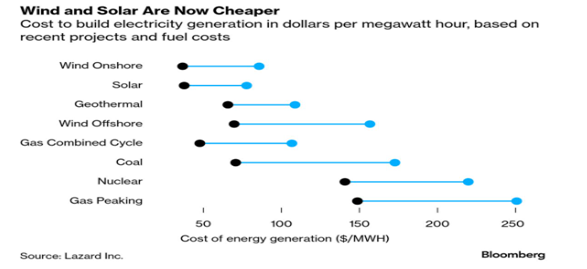

Policy does not drive technological progression – physics does. Despite headlines that express our federal government arresting wind and solar power, the sources are taking share given economics:

This chart using Lazard data and published last week by Bloomberg illustrates on a levelized cost basis solar and onshore wind are the most competitive sources of electricity to drive economic growth. So far this year, solar and wind are expanding fast enough to meet all new electricity demand, supplying 18% of global electricity demand according to Ember. For the first time, low carbon energy sources surpassed coal, and solar growth was over three times greater than any other energy source this year.

Corporate clean energy buyers are taking note.

Through November, the top corporate clean energy buyers are Meta, Google, Amazon and Microsoft globally. Google has procured over 3 gigawatts (GW) of clean energy year to date, overtaking Amazon. Solar is the dominant energy source given economics and advantages such as dispatchability, representing over 50% of all clean energy power purchase agreements this year.

Clean tech successes are not noticed by most investors

The demand drivers for clean energy, from resource efficiency to onshoring pressures are driving profits for the sector, from industrial automation to utility scale solar players. There is a direct link between economic growth and power and resource demand, and clean technology applications optimize productivity and economic growth. The profitability profiles for commercially viable clean tech companies are improving and leading to better fundamentals such as orders and margins. It is early days in the recovery, but as the stock prices for these companies continue to improve, investors may begin to take note. Think of it as the winter solstice.

Best to you for the solstice, and the holidays into year-end, and for 2026.

Disclosures:

This commentary is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. The opinions and analyses expressed in this commentary are based on Essex Investment Management LLC’s (“Essex”) research and professional experience and are expressed as of the date of its release. Certain information expressed represents an assessment at a specific point in time and is not intended to be a forecast or guarantee of future results, nor is intended to speak to any future periods. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties.

This does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product, nor does it constitute a recommendation to invest in any particular security. An investment in securities is speculative and involves a high degree of risk and could result in the loss of all or a substantial portion of the amount invested. There can be no assurance that the strategy described herein will meet its objectives generally or avoid losses. Essex makes no warranty or representation, expressed or implied; nor does Essex accept any liability, with respect to the information and data set forth herein, and Essex specifically disclaims any duty to update any of the information and data contained in the commentary. This information and data does not constitute legal, tax, account, investment or other professional advice. Essex being registered by the SEC does not imply a certain level of skill or training.

Please find important disclosures here