Giving Cleantech a Bad Name

We are cringing following the latest announced capital raise by Plug Power, Inc. Although we are not investors in Plug Power, the company frustrates us nonetheless as it highlights the type of corporate behavior that hurts the cleantech investment case. If you are unfamiliar with the Plug Power story, consider yourself lucky that you haven’t had to bear witness to its serial destruction of capital.

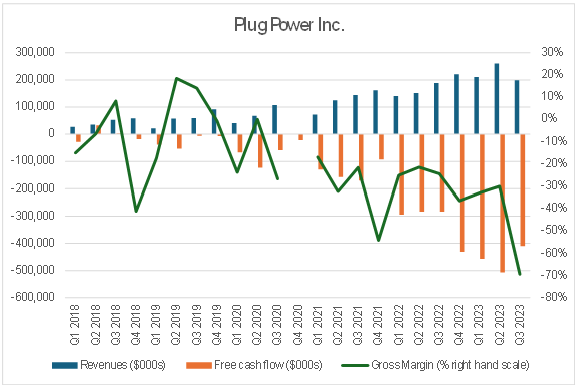

Briefly, Plug Power started life as a fuel cell company providing an alternative power source mostly for material handling equipment at warehouses (think forklifts). The concept was interesting, but the economics of the business haven’t really penciled out and Plug Power has never been profitable in its history. Free cash flow has been an equally elusive target for Plug Power, with the company burning cash on an operating basis every year even before considering cash used for capital expenditures. The challenge is that the fuel cell technology cost is still too high, especially when trying to displace entrenched, mature power solutions. To sustain this incredible incineration of capital, the company has continually come to the equity markets to raise more money.

Today, Plug Power is much more than a fuel cell company, proclaiming to “be the leader behind the end-to-end green hydrogen ecosystem”. To us, it is odd to think that a money-losing, capital-starved company operating in one segment of the unprofitable green hydrogen market (fuel cells) would expand into even more unprofitable and cash intensive parts of the green hydrogen ecosystem. Plug Power seems to be trying to gain first-mover advantage across the clean hydrogen landscape. We believe the intractable challenge is twofold: this is a hugely capital-intensive effort and the returns on capital for the technology are unproven (especially without anticipated government subsidies). We aren’t suggesting that the company abandon its efforts in the green hydrogen arena, but it would be encouraging to see some attempt at cost-cutting, focus on margin improvements or at least a more disciplined capital expenditure plan. The “go big or go home” mantra doesn’t cut it anymore.

Nevertheless, a little more than two years ago, Plug Power seemed to have solved its near-continuous thirst for capital by raising $5 billion over a five quarter span following the meteoric rise in its stock price from roughly $3 per share at the end of 2019 to more than $75 per share in early 2021 (mostly as a result of the speculative market backdrop during the zero interest rate policy period rather than to any specific breakthroughs or developments at Plug Power). This was the golden chance solidify the future of the company by materially strengthening the balance sheet and ending the perpetual chase for funding. Alas, like the degenerate gambler that hits it big in the casino but can’t walk away from the table, management confused luck with skill and decided to increase both the scope of its (unprofitable) business and its cash burn rate.

Source: Bloomberg

To say that this effort hasn’t paid off would be an understatement. Since the capital raise, the gross margin at the company has deteriorated from -17% in Q1 2021 to nearly -70% in Q3 2023 (the most recently published results). Over the same period, Plug Power has gone from a quarterly cash burn of nearly $127 million (as measured by free cash flow) in Q1 2021 to burning more than $400 million in Q3 2023. Unsurprisingly, the company has been tagged with the dreaded “going concern” label, meaning that its auditors don’t think the company can survive another 12 months without additional external funding.

Last week, Plug Power announced another $1 billion capital raise, at a price that will clearly be extremely dilutive to existing shareholders. Even worse, the capital raise is being done via an “at the market” offering, meaning that the underwriter of the deal will be selling shares on behalf of Plug Power in the open market for the foreseeable future. In other words, a very large seller will be looming over existing shareholders like the sword of Damocles, potentially hitting every uptick in the share price with additional selling pressure. The final icing on the cake is that this capital raise is only enough to get the company through the next couple of quarters and will most likely NOT remove the “going concern” language from regulatory filings.

We are discussing this example not to embarrass Plug Power (they are hardly the only public company to behave in this manner), rather we want to highlight why we emphasize stewardship of capital when evaluating management teams. Capital is scarce; it is hard earned by both companies and investors. One of the management team’s most important roles is to allocate scarce capital to the highest risk-adjusted return opportunities. Management needs to make appropriate decisions around investing in growth versus the probable outcomes and expected cost of that growth and associated returns on capital. There are plenty of good management teams in the cleantech arena acting as good stewards of capital (we believe we have a portfolio of companies led by them), but there are too many management teams like that of Plug Power that give our universe a bad name.

Disclosures:

This commentary is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. The opinions and analyses expressed in this commentary are based on Essex Investment Management LLC’s (“Essex”) research and professional experience and are expressed as of the date of its release. Certain information expressed represents an assessment at a specific point in time and is not intended to be a forecast or guarantee of future results, nor is intended to speak to any future periods. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties.

This does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product, nor does it constitute a recommendation to invest in any particular security. An investment in securities is speculative and involves a high degree of risk and could result in the loss of all or a substantial portion of the amount invested. There can be no assurance that the strategy described herein will meet its objectives generally or avoid losses. Essex makes no warranty or representation, expressed or implied; nor does Essex accept any liability, with respect to the information and data set forth herein, and Essex specifically disclaims any duty to update any of the information and data contained in the commentary. This information and data does not constitute legal, tax, account, investment or other professional advice. Essex being registered by the SEC does not imply a certain level of skill or training.

Please find important disclosures here.