Essex Global Environmental Opportunities Strategy (GEOS) November 2023 Update

Equity market volatility continued in the month of October 2023, with expanding geopolitical crises amidst continued globally tight credit conditions. As the Federal Reserve paused on interest rate hikes, the market continued to worry about a forthcoming recession, placing continued pressure on smaller, growth oriented corporate equity shares.

Long time GEOS water holding Energy Recovery recently released their fourth sustainability report and published their Scope 1-3 emissions for the first time. Energy Recovery devices help prevent over 17.3 million metric tons of CO2 from entering the atmosphere each year, according to the report. Energy Recovery has set some important goals:

-align with the Taskforce on Climate-related Financial Disclosures by 2024

-double emissions reductions by the end of 2025 versus a 2019 baseline

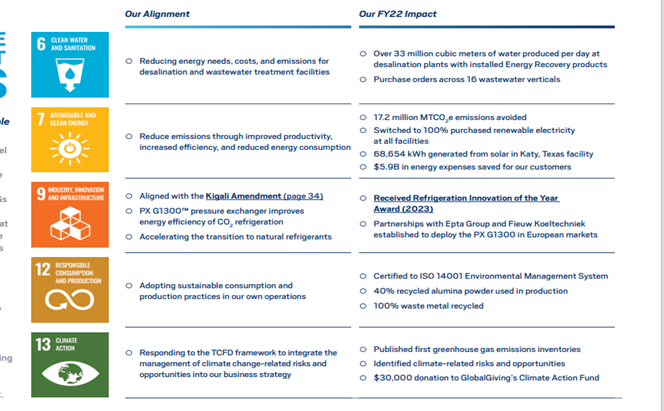

We use the UN Sustainable Development Goals (SDGs) to demonstrate how GEOS holdings are having an impact on global problems, amidst the increased commitments to strive for Net Zero with more aggressive time frames. Energy Recovery has provided clear examples of their impact across the five SDGs they solve – please see the following exhibit from their report:

It is important to demonstrate climate and social solutions as technologies are scaled, exhibiting clearly to the market SDG progress. We have spent several years educating our holdings, and the market this importance, to illustrate real market impact case studies, bringing stock holdings to life, amidst times when most asset owners are not familiar with true impact, and relevant climate tech examples.

Collectively, the GEOS portfolio management team has been analyzing and investing in the clean technology arena for over 30 years. This is the most difficult environment for equity returns within the sector we can recall. We have some GEOS holdings that are trading at multiples that do not factor any earnings growth in the future, and a few that are trading essentially for cash. Sentiment is the worst we have observed, yet our companies continue to execute, despite market beliefs,

One prime example is MP Materials (MP), the rare earth supplier based in Las Vegas and held in the GEOS efficient transport theme. Rare earths are key inputs for clean technologies, from magnets for wind turbines, to electric motors for industrial robotics and EVs. Rare earths are almost exclusively controlled by China, a risk highlighted by the US Department of Defense as a grave threat to our economy, and in our opinion, progress for a competitive edge in the new energy revolution. MP is the only producer of scale for rare earths outside China, with the most advanced mining and processing facility in Mountain Pass, an hour from Las Vegas. The Mountain Pass facility was acquired in 2017 from Molycorp, who could never properly execute production. MP has been working for the past few years on optimizing this closed-loop, industry leading zero discharge facility to mine bastnaesite ore, purify and separate, to finish neodymium praseodymium (NdPr). The Mountain Pass ore has very high rare earth content of 7% – most locations are about 1%, leading to competitive advantage in cost and content. MP has distribution agreements for NdPr oxide with Sumitomo in Japan, a county making 10% of rare earth magnets. MP is finishing a magnet facility in Texas, with offtake agreements from Ford and Tesla. MP’s third quarter results were strong with positive earnings per share for the first time, and improving cash flow as production for its Stage I plant finalizes. MP is well capitalized with over $1 billion of cash on the balance sheet, providing a buffer to near term commodity price volatility. We believe MP provides a strong example of the opportunities at hand with a market like P/E multiple and over 60% sales growth out 24 months according to our analysis. The clean technology fundamentals are not recognized as favorable currently, but we believe investors will be rewarded given the massive disconnect between long term themes and current valuations.

Disclosures:

This commentary is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. The opinions and analyses expressed in this commentary are based on Essex Investment Management LLC’s (“Essex”) research and professional experience and are expressed as of the date of its release. Certain information expressed represents an assessment at a specific point in time and is not intended to be a forecast or guarantee of future results, nor is intended to speak to any future periods. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties.

This does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product, nor does it constitute a recommendation to invest in any particular security. An investment in securities is speculative and involves a high degree of risk and could result in the loss of all or a substantial portion of the amount invested. There can be no assurance that the strategy described herein will meet its objectives generally or avoid losses. Essex makes no warranty or representation, expressed or implied; nor does Essex accept any liability, with respect to the information and data set forth herein, and Essex specifically disclaims any duty to update any of the information and data contained in the commentary. This information and data does not constitute legal, tax, account, investment or other professional advice. Essex being registered by the SEC does not imply a certain level of skill or training.