Essex Global Environmental Opportunities Strategy (GEOS) October 2023 Update

In his 1987 letter to shareholders, Warren Buffett described the difference between short term trading and long-term investing using the metaphor of a voting machine versus a weighing machine. In the near term, the market can behave like a political contest, determining equity share prices based on popularity, driven by sentiment and speculation – a voting machine. In the longer term, the market and stock prices should reflect business fundamentals, weighing the business and its earnings prospects over time. We believe this metaphor is particularly apropos now given what we believe is an overreaction to recent economic and geopolitical events, and the voting popularity of a few stock market constituents. Voting for shares in the clean tech district experienced extremely negative polling for the third quarter of 2023, as the market sold off or took short interest in smaller, growth-oriented companies. We believe the investment case for the Essex Global Environmental Opportunities Strategy (GEOS) is well intact, and recent market dislocation presents significant opportunity for investors seeking exposure to companies solving environmental problems. The sell-off is overdone, over reflecting the interest rate cycle, to say nothing of the long-term fundamental case for our thesis – investing in companies that expedite natural resource efficiency and solve environmental problems, from clean air and water to independent, non-fossil fuel energy sources which lessen business risks.

The Essex Global Environmental Opportunities Strategy was created to invest in companies solving global environmental problems, with the intent and belief that solutions to environmental problems are opportunities for investors. The technologies and services represented by the public equity shares held by GEOS have environmental and social impact, as their solutions are scaled into the markets. We invest thematically in technologies we believe are positioned commercially and financially to offer strong earnings per share over time, defined as three to five years. We determine commercial viability as technologies and services that are scaling commercially because they make sense – they provide a means to save money and resources for adopters, lessen risks such as commodity risk, or make the workplace safer. Commercial viability means the offering goes well beyond a concept that works in a lab. As a technology across one of our nine GEOS themes scales, the potential for profitability and earnings per share growth increases. This process does not lead with the consideration of policy, regulations, or other government support – the policy considerations are part of the appraisal, not the primary focus. Commercially viable environmental solutions do not need government support to succeed – policy support is just one potential catalyst.

GEOS solves environmental problems such as the need for severe weather resiliency for electrical grid infrastructure, or the need for cleaner electrons to power commerce in the face of increasingly severe climate change. We have described GEOS as investing in climate solutions, or outputs – technologies that solve many environmental and social problems. This is impact, and we provide examples of impact on a regular basis. We would characterize GEOS as high impact within the listed equity arena, given our focus on investing to solve environmental problems driven by secular and demographic changes on a global scale. GEOS is environmental, and impact, representing technologies that enable sustainability. Another way to think of GEOS is enabling the net zero supply chain, to decarbonize our economy. We analyze and invest in companies representing these solutions to global problems opportunistically. GEOS goes beyond just investing in companies that sign onto net zero pledges, or companies with good ESG ratings from data firms. GEOS enables net zero – beyond a signatory position – an aspiration, to enabling the net zero economy. The technologies represented by GEOS most likely are being invested in by large companies in the ESG ratings spotlight. This is a very differentiated approach, and very few asset managers have this objective. Just last week we were speaking with a large ESG data firm, and the analyst said, “no one has the approach you guys are taking.” This is very important, in the face of ESG political battles, SEC studies and oversights regarding ESG, labeling changes, academic papers on ESG returns studies, and engagement announcements on proxy wins. We believe there is no such thing as an “ESG stock.” ESG data can be utilized just as any data, for securities analysis. All data is noisy – that is what makes the market. We embrace the noise, as we invest in companies providing solutions to solve the greatest environmental challenges our world faces and believe this is the greatest opportunity of our lifetimes. GEOS has never changed its approach or label because the opportunity is at hand, as is our commitment.

The negativity surrounding clean tech stocks is the most we have experienced in our careers. From political attacks against EVs and renewables, to the oft repeated yet uninformed statements that renewables and other solutions such as stationary storage are solely dependent on government support. Well, let’s do some fact checking:

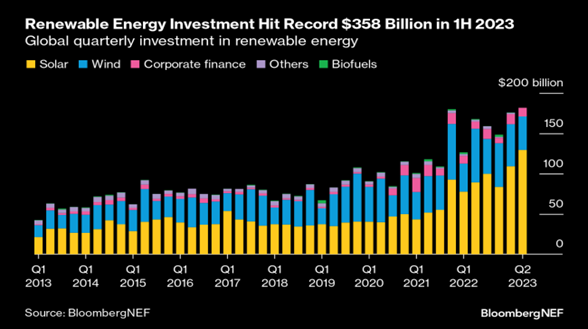

First, uninformed banter exists primarily in the US. Globally, renewable energy investment hit a record $358 billion in the first half of 2023:

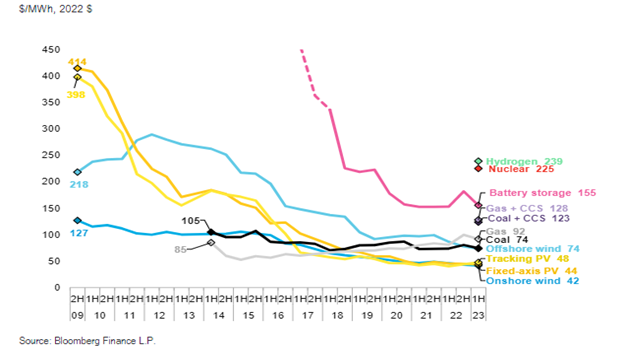

Why? Because renewables are the cheapest form of electrons. The following chart depicts global levelized cost of energy (LCOE) to the first half of 2023, on a dollar/MWh basis. The LCOE is a measure of the average net present cost of electricity generation over an asset’s life, from a coal fired power plant to a wind farm. Given the technological advances of renewables and other distributed services the past 20 years, onshore wind, solar and even offshore wind are the cheapest sources of electrons – cheaper with lower operating costs than any fossil fuel source. As importantly, these new clean technologies are more flexible, green electrons isolating users from fossil fuel pricing risks.

In the US, this cost advantage is making a dent in our current energy mix, as renewable energy now equates to over 20%, led by solar. Alternatives such as nuclear and fuel cells comprise 20%, and the old buggy whips of oil, coal and natural gas are 60% (source: US DOE, EIA). Fossil fuel subsidies globally are expected to be over $6.5 trillion this year according to the IMF, a drop in the bucket relative to even our US incentive structures that are under attack. Leading corporations deploy capital efficiently for profitability and have flocked to renewable power purchase agreements given the leading economics.

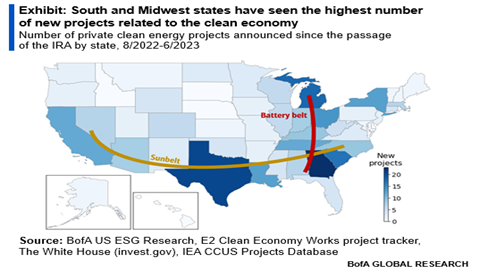

The adage to watch actions over words should be heeded with the recent negative commentary stemming from the GOP pushing back on clean tech development and the IRA:

The Inflation Reduction Act (IRA) has already created over 270 new clean energy project announcements totaling $130 billion for state economies with over 90,000 jobs. As we enter an election cycle, we would bet that clean tech project development will – and should be positioned as infrastructure, onshoring, American made, and a new industrial revolution. These advancements are all happening with greater scale in GOP-led states and districts. Commercially viable solutions to environmental problems need to be solved and scaled now, apolitically, across global economies. We trust level heads will prevail in accepting, leveraging and weighing these solutions in time. In the meantime, it is time to exploit the current market voting machine for long term investment opportunity.

Disclosures:

This commentary is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. The opinions and analyses expressed in this commentary are based on Essex Investment Management LLC’s (“Essex”) research and professional experience and are expressed as of the date of its release. Certain information expressed represents an assessment at a specific point in time and is not intended to be a forecast or guarantee of future results, nor is intended to speak to any future periods. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties.

This does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product, nor does it constitute a recommendation to invest in any particular security. An investment in securities is speculative and involves a high degree of risk and could result in the loss of all or a substantial portion of the amount invested. There can be no assurance that the strategy described herein will meet its objectives generally or avoid losses. Essex makes no warranty or representation, expressed or implied; nor does Essex accept any liability, with respect to the information and data set forth herein, and Essex specifically disclaims any duty to update any of the information and data contained in the commentary. This information and data does not constitute legal, tax, account, investment or other professional advice. Essex being registered by the SEC does not imply a certain level of skill or training.

Please find important disclosures here.