Essex Global Environmental Opportunities Strategy (GEOS) September 2023 Update

The month of August 2023 was a very difficult month for equities, especially smaller public equity shares. While it is hard to generalize an earnings season, second quarter earnings were muted, with many companies meeting earnings expectations at the low end of guidance. Market breadth, a measure of sentiment, was back to March 2023 lows, after broader participation in June and July. Investor risk appetite was diminished to zero, other than for the few artificial intelligence technology stocks. For several of the Essex Global Environmental Opportunities Strategy (GEOS) holdings, if guidance was lowered for 2023 given, for example some push outs of large project bookings, the stocks corrected in the double digits as investors reacted to headlines only, not nuanced underlying fundamentals. Investors in this case are quantitative hedge funds that react primarily to headlines and trading volumes, not microeconomic business conditions. This is the most difficult of environments for our GEOS investment process, and one we have experienced a few times in the past.

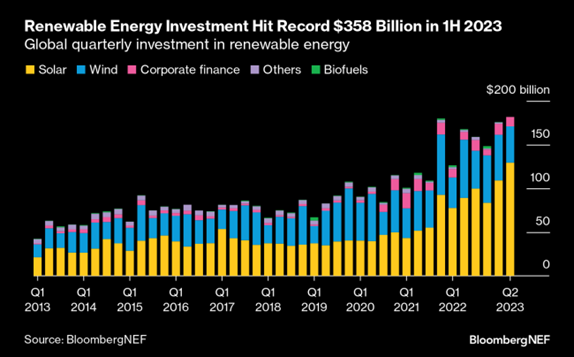

Despite the tepid performance of listed equity clean tech the past several months, the sector is experiencing record capital inflows, as businesses continue to inoculate themselves from commodity and business risks:

This chart depicts global investment in the developed and developing markets. Many projects reflect the trend of corporates investing directly in their own renewable generation assets such as solar arrays, or the move to renewable power purchase agreements. There is a great disconnect currently between the underlying fundamentals of renewables and the state of the listed equity market regarding price appreciation.

Shoals Technologies Group is a company directly benefiting from the drive for independent, distributed energy sources. Shoals provides electrical balance of systems (EBOS) solutions for solar arrays that lower installation costs while speeding up deployment. For a large, ground mounted solar array, over 50% of the infrastructure cost is associated with the temporal aspects of deployment, including cables, connectors, civil work and long cable runs. Shoals solutions can reduce on site labor costs by 40%, and decrease material costs by over 20%. Shoals technology is also deployed for EV charging, where they have over 30% market share. Shoals solves four of the UN Sustainable Development Goals (SDGs): 13 – climate action; 9 – industry, innovation and infrastructure; 11- sustainable cities and communities; and 7 – affordable and clean energy.

There is a significant disconnect between recent stock price performance relative to our GEOS investment thesis, in owning the public equity shares of companies delivering environmental solutions. We believe the case for GEOS resonates stronger than ever, as the world rapidly needs to generate economic growth with fewer resources. The case for environmental solutions can be made from many angles: geopolitically, war and trade tensions make the case for economic onshoring and energy independence; economically, companies need to execute business plans amidst the vagaries of volatile commodity prices, interest rates and supply chains; scientifically, severe weather from wildfires, floods and heat waves are disrupting everyday life across the globe. Each of our themes is positioned to own the shares of companies delivering cleaner and more economic solutions to environmental problems.

We believe most of the recent underperformance is not due to a decline in our investment thesis. There are exceptions, such as offshore wind, which is experiencing challenges with greater costs and lower returns due to supply chain issues and higher interest rates. In this case, we recently sold a company with sole revenue exposure to offshore wind given continued cost pressures. The solar industry is growing, yet currently led by utility scale solar and not residential, given declining consumer interest as installation costs increase. GEOS solar exposure is centered on technologies that improve utility scale solar productivity and promote electrical grid connection and lessen complexities. For most holdings, stock prices have been volatile as investors bet against smaller growth companies amidst interest rate pressures. We believe these bets are being made by looking at headlines and market capitalizations, not underlying corporate fundamentals which these shares represent. Our GEOS portfolio weights reflect measured and tenured portfolio construction, of which risk management and assessment play an integral part. This assessment considers industry maturity, financial quality, liquidity, short interest levels, individual security volatility, scenario analysis monitoring, the regulatory and current economic environment, and our performance expectations. For example, many of the companies in the portfolio with the most volatility are shares with weights under 2%, given our construction thesis. This disconnect is unlike anything we have seen in the 14+ year GEOS track record, as investors flock to a very narrow segment of the equity market. It is for this reason and our thesis that we have been taking advantage of the down draft to revisit and repurchase the shares of companies that heretofore we deemed overvalued. We are taking a similar approach to existing holdings and added weights to high conviction positions. As market risk appetite is low, we believe the clean tech sector and GEOS more specifically, one which is ignored currently, will recover when interest rates moderate, and risk appetite returns. In the interim, we will continue to take advantage of this great opportunity to assess and meet with companies providing commercially viable environmental solutions that meet our investment thesis.

Disclosures:

This commentary is for informational purposes only. It does not constitute investment advice and is not intended as an endorsement of any specific investment. The opinions and analyses expressed in this commentary are based on Essex Investment Management LLC’s (“Essex”) research and professional experience and are expressed as of the date of its release. Certain information expressed represents an assessment at a specific point in time and is not intended to be a forecast or guarantee of future results, nor is intended to speak to any future periods. Accordingly, such statements are inherently speculative as they are based on assumptions that may involve known and unknown risks and uncertainties.

This does not constitute an offer to sell or the solicitation of an offer to purchase any security or investment product, nor does it constitute a recommendation to invest in any particular security. An investment in securities is speculative and involves a high degree of risk and could result in the loss of all or a substantial portion of the amount invested. There can be no assurance that the strategy described herein will meet its objectives generally or avoid losses. Essex makes no warranty or representation, expressed or implied; nor does Essex accept any liability, with respect to the information and data set forth herein, and Essex specifically disclaims any duty to update any of the information and data contained in the commentary. This information and data does not constitute legal, tax, account, investment or other professional advice. Essex being registered by the SEC does not imply a certain level of skill or training.

Please find important disclosures here